This article is original content written by Thomas Scanlon, CPA, CFP® of Manchester, CT.

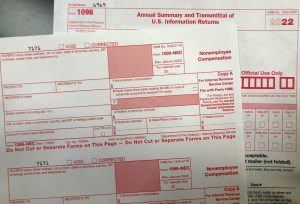

The IRS requires business taxpayers to report amounts paid as non-employee compensation on Form 1099-NEC.

Non-employee compensation will be reported in box one of the Form 1099-NEC and is generally considered self-employment income and likely subject to self-employment tax to the recipient. Any payments to individuals that are not reported on Form 1099-NEC are likely still reported on form 1099-MISC. Examples of these payments would include items such as prizes, awards, fees and other non-business related services.

You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment.

To properly complete Form 1099 you will need to secure Form W-9. This form provides the information needed to complete the 1099 (see more info on form W-9 here). The person’s name, address and social security number (or federal Tax ID#) will be listed. This form is not forwarded to the IRS. Employers need to maintain this form on file.

Connecticut business taxpayers must file the CT 1099-NEC or CT 1099-MISC along with CT 1096. January 31, 2023 is the deadline for filing the 2022 1099 Forms. Form 1096 is the “cover sheet” summary you send to the IRS with a copy of the 1099’s. Failure to file these returns timely will result in penalties.

For additional information visit the IRS.gov and/or portal.ct.gov websites.