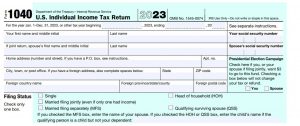

Anticipated IRS Refund Schedule 2024

In 2024, the IRS will commence with electronic filing on January 29th. Taxpayers who select direct deposit should anticipate their refunds within 21 days of the IRS receiving their tax return, when they file electronically, barring any issues with processing their tax returns. Electronic filing, when linked with direct deposit, is the fastest way to get a refund. If you opt for a paper check, it may take around four weeks for delivery. Ensure timely filing by meeting the April 15, 2024, deadline to avoid penalties and interest on any unpaid taxes. By e-filing, you can potentially speed up the process, though it’s essential to note that individual circumstances can influence the actual processing time.

What’s New and What to Consider

R-2023-235, Dec. 11, 2023

WASHINGTON — The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year.

This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season. The Get ready page on IRS.gov outlines steps taxpayers can take now to make filing easier in 2024.

Here’s what’s new and what to consider before filing next year.

IRS Online Account Enhancements

Taxpayers and Individual Taxpayer Identification Number (ITIN) holders can now access their Online Account and view, approve and electronically sign power of attorney and tax information authorizations from their tax professional.

With an Online Account, individuals can also:

- View their tax owed and payment history and schedule payments.

- Request tax transcripts.

- View or apply for payment plans.

- See digital copies of some IRS notices.

- View key data from their most recently filed tax return, including adjusted gross income.

- Validate bank accounts and save multiple accounts, eliminating the need to re-enter bank account information every time they make a payment.

Avoid Refund Delays and Understand Refund Timing

Many different factors can affect the timing of a refund after the IRS receives a tax return. Although the IRS issues most refunds in less than 21 days, the IRS cautions taxpayers not to rely on receiving a 2023 federal tax refund by a certain date, especially when making major purchases or paying bills. Some returns may require additional review and may take longer to process if IRS systems detect a possible error, the return is missing information or there is suspected identity theft or fraud.

See other IRS News here.

As January comes to an end, the anticipation of filing tax returns is looming over me. The article “Get Ready to File Your Tax Returns in 2024-Jan 29, 2024 Official Start!” resonates with my current situation, as I gear up to navigate the labyrinth of tax documents. The official start date mentioned is a reminder that it’s time to gather W-2s, receipts, and other necessary paperwork. Personally, I’ve always found the tax season to be both a meticulous task and a moment of financial reflection. This article serves as a timely nudge for me to organize my documents and ensure a smooth filing process. Here’s to embracing the annual ritual of tax filing with a sense of responsibility and financial mindfulness.